On May 10th, the "Seminar on the Reform and Development of China's Capital Market and the Theory Seminar of 'Theoretical Logic of China's Capital Market' (10-volume set)" jointly organized by the National Institute of Finance of Renmin University of China and Industrial Securities Co., Ltd. was held. More than 30 experts and scholars from government departments, financial institutions, universities and research institutes gathered to discuss the theoretical logic and practical path of the development of China's capital market.

Zhang Donggang, the Party Secretary of Renmin University of China, Yang Huahui, the Party Secretary and Chairman of Industrial Securities Co., Ltd., Chen Bo, the Party Secretary and Chairman of China Finance Publishing House Co., Ltd., Wang Jun, a senior editor of China Finance Publishing House and the editor-in-chief of "Theoretical Logic of China's Capital Market" (10-volume set), and Wu Xiaqiu, a first-class professor, the director of the National Institute of Finance of Renmin University of China and the director of the Institute of China's Capital Market, attended the event. Zheng Xinye, the vice president of Renmin University of China, presided over the meeting.

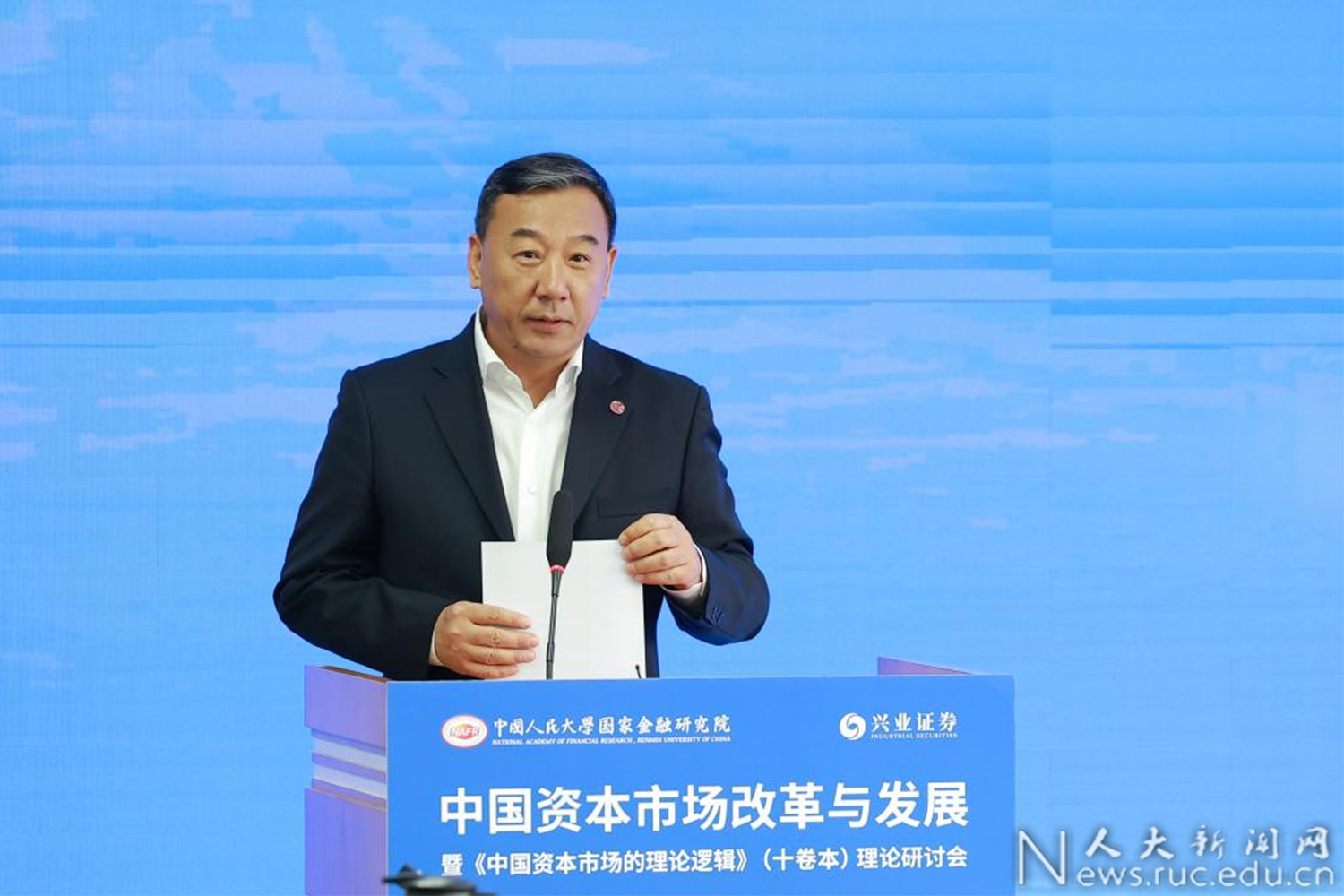

Zhang Donggang said that under the new situation, promoting the high-quality development of the capital market is not only an inherent requirement for serving the high-quality development of the economy and an important support for building a strong financial country, but also an inevitable choice to effectively solve the problems and contradictions in the capital market. "Theoretical Logic of China's Capital Market" (10-volume set) focuses on the reform and development of China's capital market from a unique perspective, systematically constructs the theoretical framework for the development of China's capital market, and fully embodies the profound thinking on the future prospects of China's capital market. It sets an academic benchmark for the theoretical research of China's capital market with Chinese characteristics and provides important theoretical support for the reform and development of the capital market. He hopes that experts and scholars will take this seminar as an opportunity to exchange ideas, reach consensus, lay a solid theoretical foundation, gather wisdom for the development of the capital market, consolidate the disciplinary foundation, provide energy for the development of the capital market, and cultivate a large number of talents to provide strength for the development of the capital market.

Yang Huahui said that since the 18th National Congress of the Communist Party of China, the reform and development of the capital market have been elevated to a strategic height. From the perspective of the securities industry, the reform and development of the capital market can be driven in four directions: deepening the registration system reform as the engine, taking the "five major articles" as the strategic coordinates, taking high-level opening up as the path, and taking the construction of the rule of law as the cornerstone. He said that the reform of the capital market will never stop. In the new journey of assisting the construction of Chinese-style modernization, it will continue to play an important role and provide key support for building a new development pattern.

Chen Bo said that China Finance Publishing House has maintained a long-term and close cooperation with Renmin University of China for nearly 70 years. "Theoretical Logic of China's Capital Market" (10-volume set) is about 3.5 million words and includes Professor Wu Xiaqiu's academic achievements over 18 years, covering major issues such as the reform and development of China's capital market, as well as pioneering insights on financial reform, market opening up, and the construction of a strong financial country. He looks forward to establishing and maintaining cooperative relationships with more experts and scholars to disseminate the latest developments in financial academia.

Wang Jun said that "Theoretical Logic of China's Capital Market" (10-volume set) includes 388 academic and commentary articles by Professor Wu Xiaqiu over 18 years, systematically presenting his profound insights in capital market research. The book focuses on the theoretical logic of the development of China's capital market, discusses key issues such as financial structure and the construction of a strong financial country, and also covers his unique perspectives on macroeconomics and higher education.

Wu Xiaqiu said that the capital market has always played a key role in China's economic development, and how to promote its reform and development is an important research topic. The future development trend of China's finance determines the structural transformation of finance, and the positioning of the capital market should shift from a financing market to an investment market. It is hoped that "Theoretical Logic of China's Capital Market" (a ten-volume set) can help all sectors of society to have a clearer understanding of the operational laws of the capital market, provide theoretical references for improving market mechanisms and protecting investors' rights and interests, and contribute to the construction of a more dynamic modern financial system. The set was edited by Zheng Xinye.

During the expert discussion session, scholars including Tu Guangshao, the founding president of the Shanghai New Finance Research Institute and former vice chairman of the China Securities Regulatory Commission, Gao Peiyong, academician and former vice president of the Chinese Academy of Social Sciences, Li Daokui, director of the Institute of Chinese Economic Thought and Practice at Tsinghua University, Ding Zhijie, director of the Institute of Finance of the People's Bank of China, Liang Qi, deputy secretary of the Party Committee of Nankai University, Wu Weixing, president of Capital University of Economics and Business, Liu Liya, vice president of Shanghai University of Finance and Economics, Wang Han, chief economist of Industrial Securities Co., Ltd., Wang Guoqiang, a national first-class professor at Renmin University of China, and Zhao Xijun, co-director of the China Capital Market Institute at Renmin University of China, engaged in in-depth discussions on the theme of capital market reform and development. The session was chaired by Zhuang Yumin, dean of the School of Finance at Renmin University of China and executive director of the National Institute of Finance.

"Theoretical Logic of China's Capital Market" (a ten-volume set) was written by Professor Wu Xiaqiu, a renowned financial scholar in China, and published by China Financial Publishing House. It is a systematic summary and forward-looking reflection on the development process of China's capital market. The set contains 3.5 million words and includes Wu Xiaqiu's academic papers, commentaries, professional speeches, and important interviews from 2007 to 2024. It showcases his profound insights into issues such as capital market system construction, financial structure, financial risks, and regulation, outlining the theoretical framework of China's capital market reform and development, and providing important ideological resources and theoretical support for the future reform of China's capital market.