On January 17, 2024, the Second Asia “Smart Finance and Accounting” Teaching Seminar was organized by Singapore Management University (SMU) and Renmin University of China (RUC), co-hosted by Renmin Business School (RMBS), Singapore Management University School of Accountancy, Renmin University Press, the Ministry of Education’s Virtual Teaching and Research Room for Financial Management Courses, and the Smart Finance and Accounting Alliance. The seminar was conducted online, attracting over 3,500 participants who watched the live broadcast.

The theme of this seminar was “Sustainable Development and Finance and Accounting Education”. Guests such as Yi Jingtao, Dean of RMBS and Cheng Qiang, Dean of SMU School of Accountancy, attended. The seminar was co-hosted by Professor Wu Wuqing from RMBS and Associate Professor Wang Jiwei from SMU School of Accountancy.

Yi Jingtao talked about the collaboration between RMBS and SMU School of Accountancy, sharing successful approaches in smart finance education. Cheng Qiang highlighted SMU’s achievements in teaching ESG and accounting science.

Yi Jingtao highlighted the need for constant innovation in finance and accounting education amid digital advancements and emerging issues like ESG. He expressed the hope that the seminar could be a forum to explore a teaching approach combining artificial intelligence and sustainable development concepts.

Cheng Qiang highlighted that, given the current digital era, accounting and finance scholars must grasp changes in enterprise strategies due to digitization. They play a crucial role in guiding students to learn and adapt to new trends.

In the conference reports, speakers included Professor Poh Sun Seow, Associate Professor Holly Yang from SMU School of Accountancy, Associate Professor Liang Hao, and Professor Xu Nianxing from RMBS.

Poh Sun Seow highlighted “student-centered learning”, emphasizing teachers’ focus on personal growth, not just academic performance. He shared strategies like feedback, increased engagement, and relevant teaching materials. Using the SMU Challenge App as an example, he showcased SMU’s efforts in enhancing teaching materials and fostering independent student learning in the digital age.

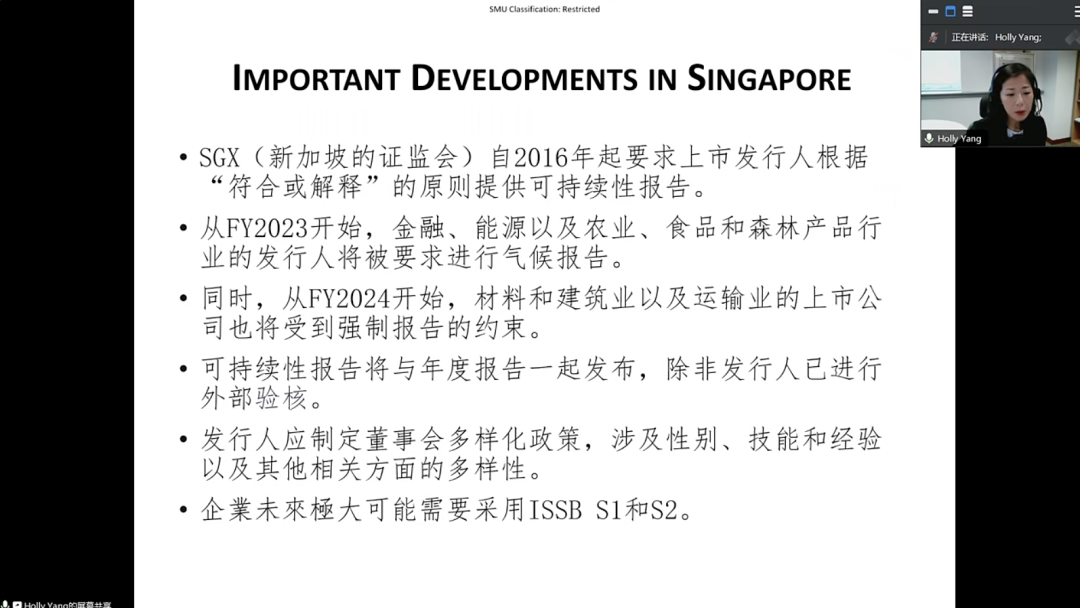

Holly Yang shared SMU’s experience in teaching a sustainability reporting course, covering material selection, teaching process design, and insights into global sustainability trends and regulations.

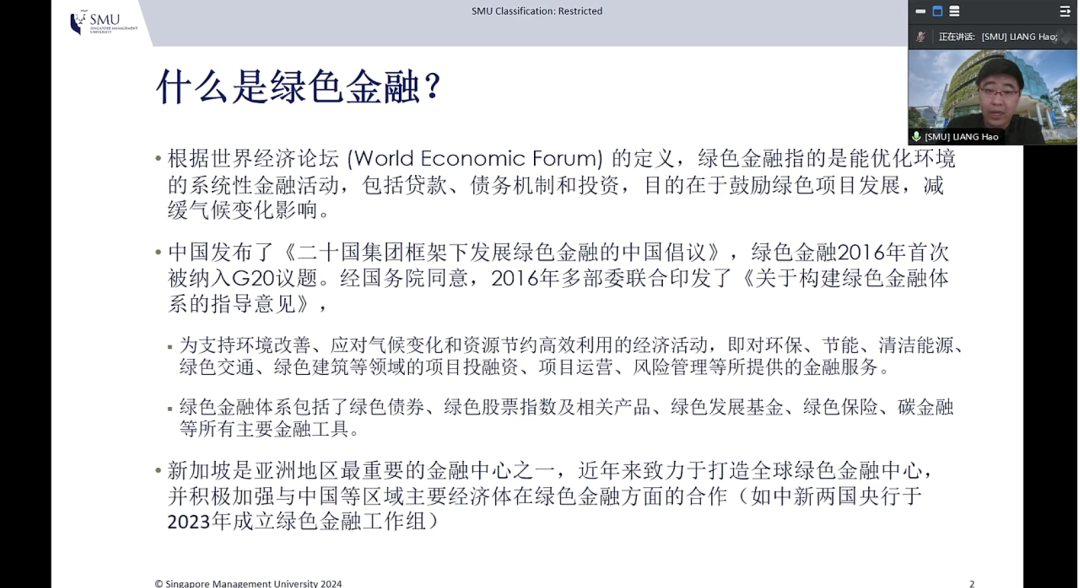

Liang Hao discussed the definition of “Green Finance” and its course content, covering topics like “Enterprise Green Transformation” and “Financial Markets”. He also mentioned current trends and research opportunities in green finance.

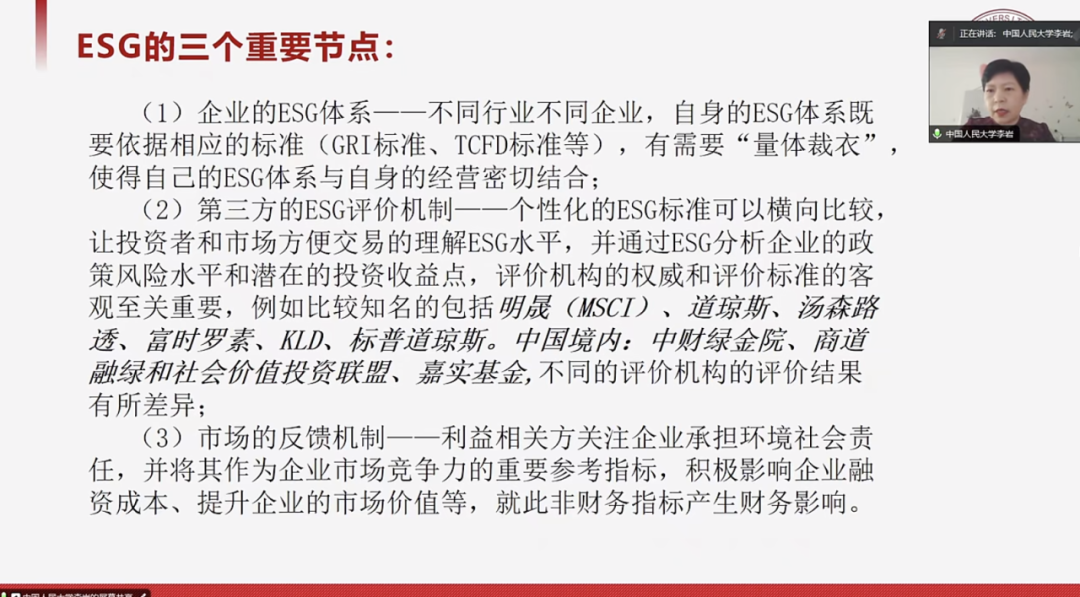

Li Yan shared how ESG practices enhance corporate competitiveness, focusing on China’s ESG disclosure. She discussed the impact of enterprise ESG from three aspects: the enterprise ESG system, third-party evaluation, and market feedback. She emphasized the importance of talent cultivation for corporate ESG.

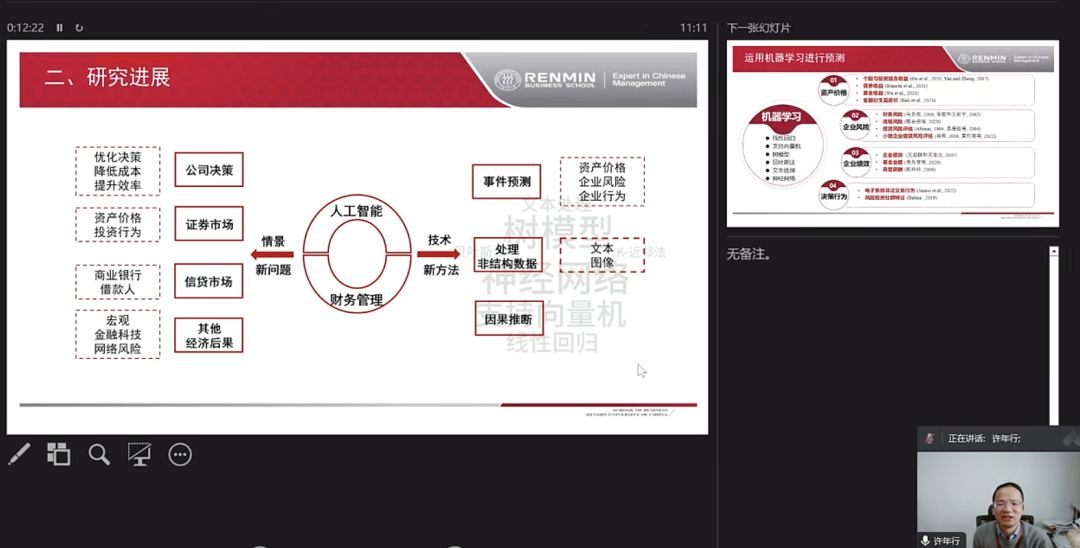

Xu Nianxing presented advancements in AI-driven financial management research, reviewing literature and methods. He highlighted the latest applications in finance and the potential use of AI in ESG research.

In the online teaching discussion segment, participants discussed challenges in combining artificial intelligence with finance and accounting teaching, how to cultivate ESG talents, and the demand for ESG talents.

In the seminar’s conclusion, Zhang Min, Director of RMBS Accounting Department, summarized the event, thanked participants, and expressed eagerness to enhance collaboration with SMU School of Accountancy for advancing finance and accounting education in Asia.