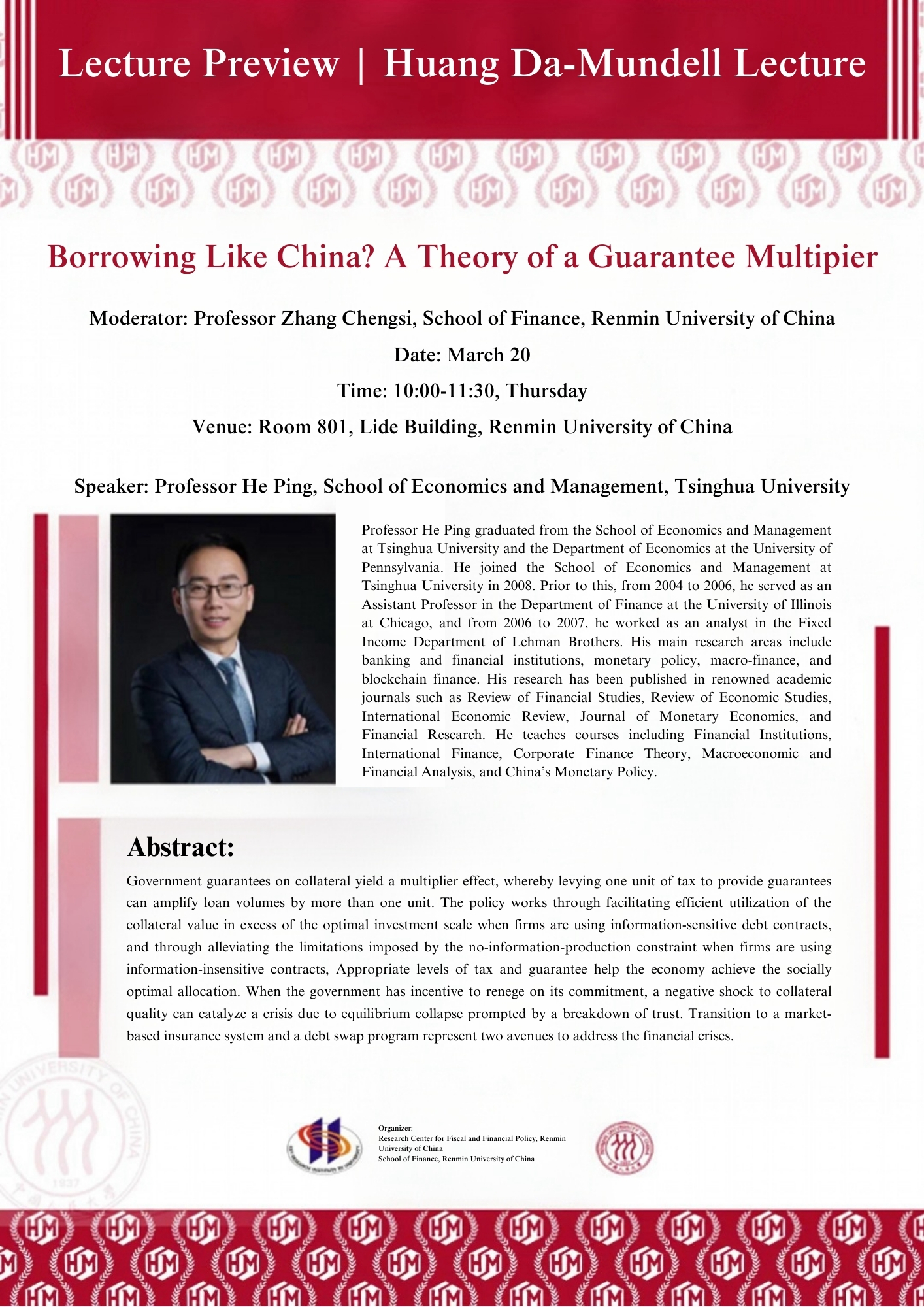

Speaker: Professor He Ping, School of Economics and

Management, Tsinghua University

Moderator: Professor Zhang Chengsi, School of Finance, Renmin

University of China

Date: March 20

Time: 10:00-11:30, Thursday

Venue: Room 801, Lide Building, Renmin University of

China

Organizer:

Research Center for Fiscal and Financial Policy,

Renmin University of China

School of Finance, Renmin University of China

About the speaker:

Professor He Ping graduated from the School of Economics and Management at

Tsinghua University and the Department of Economics at the University of

Pennsylvania. He joined the School of Economics and Management at Tsinghua

University in 2008. Prior to this, from 2004 to 2006, he served as an Assistant

Professor in the Department of Finance at the University of Illinois at

Chicago, and from 2006 to 2007, he worked as an analyst in the Fixed Income

Department of Lehman Brothers. His main research areas include banking and financial

institutions, monetary policy, macro-finance, and blockchain finance. His

research has been published in renowned academic journals such as Review of

Financial Studies, Review of Economic Studies, International Economic Review,

Journal of Monetary Economics, and Financial Research (《金融研究》). He teaches

courses including Financial Institutions, International Finance, Corporate

Finance Theory, Macroeconomic and Financial Analysis, and China’s Monetary

Policy.

Abstract:

Government guarantees on collateral yield a multiplier effect, whereby levying one unit of tax to provide guarantees can amplify loan volumes by more than one unit. The policy works through facilitating efficient utilization of the collateral value in excess of the optimal investment scale when firms are using information-sensitive debt contracts, and through alleviating the limitations imposed by the no-information-production constraint when firms are using information-insensitive contracts, Appropriate levels of tax and guarantee help the economy achieve the socially optimal allocation. When the government has incentive to renege on its commitment, a negative shock to collateral quality can catalyze a crisis due to equilibrium collapse prompted by a breakdown of trust. Transition to a market-based insurance system and a debt swap program represent two avenues to address the financial crises.